pa estate tax exemption 2020

Estates of decedents survived by a spouse may elect to pass any of the decedents unused exemption to the surviving spouse. Apportionment of Pennsylvania estate tax.

Pennsylvania Inheritance Tax Explained

PUBLIC TRANSPORTATION ASSISTANCE TAXES AND FEES PTA ADDITIONAL LOCAL CITY COUNTY HOTEL TAX This form cannot be used to.

. Estates and trusts are entitled to. Must prove financial need. Many are pleased to know that they need not worry about federal estate tax since Uncle Sam imposes this levy in the year 2022 only if the estate exceeds 1206 million.

The one-time bonus rebate will be equal to 70 of your original rebate amount. Get information on how the estate tax may apply to your taxable estate at your death. VEHICLE RENTAL TAX VRT On Reverse Carefully.

The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019. They are required to report and pay tax on the income from PAs eight taxable classes of income that they receive during their taxable year. Philadelphia PA 19115 REAL ESTATE TAX RELIEF HOMESTEAD Final Deadline to apply for the Homestead Exemption is December 1 2020.

The Pennsylvania tax applies regardless of the size of the estate. One-Time Bonus Rebates for 2021 Claimants of Property TaxRent Rebate Program. Pennsylvania Inheritance Tax Safe Deposit Boxes.

Estates and trusts are taxpayers for Pennsylvania personal income tax purposes. Ad Access Tax Forms. Download Or Email PA REV-72 More Fillable Forms Register and Subscribe Now.

3 The organizations conduct must be primarily supported by government grants or contracts funds solicited from its own membership congregation or previous donors and. REV-1197 -- Schedule AU -- Agricultural Use Exemptions. Family Exemption 3121.

This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax Exemption when a purchase of 200 or more is made by an organization which is registered with the PA Department of Revenue as an exempt organization. STATE 6 AND LOCAL 1 HOTEL OCCUPANCY TAX. 15 for asset transfers to other heirs.

FORM TO THE PA DEPARTMENT OF REVENUE. 11400000 in 2019 11580000 in 2020 11700000 in 2021 and 12060000 in 2022. 1 Organization must be tax-exempt under the Internal Revenue Code.

Veteran must prove financial need according to the criteria established by the State Veterans Commission if their annual income exceeds 95279 effective Jan. The same however cannot be said of Pennsylvania inheritance tax. Applicants with an annual income of 95279 or less are given a rebuttable presumption to have a need for the exemption.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Pennsylvanians who are approved for a rebate on property taxes or rent paid in 2021 will receive an additional one-time bonus rebate later this year. November 19 2019 Posted by RLA Estate Planning Law News and Press Probate Real Estate Law Tips Trust Administration.

Property that is owned jointly between two spouses is exempt from inheritance tax. The tax rate for Pennsylvania Inheritance Tax is 45 for transfers to direct descendants lineal heirs 12 for transfers to siblings and 15 for transfers to other heirs except charitable organizations exempt institutions and government entities that are exempt from tax. Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide.

Payment from real estate. Complete Edit or Print Tax Forms Instantly. The tax rate varies depending on the relationship of the heir to the decedent.

Applicants approved after this date will receive a second bill. REV-720 -- Inheritance Tax General Information. REV-714 -- Register of Wills Monthly Report.

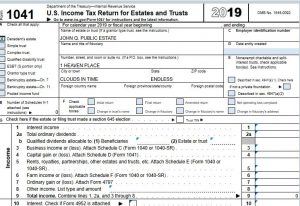

This election is made on a timely. Estates and trusts report income on the PA-41 Fiduciary Income Tax return. Early filers should apply by September 13 2020 to see approval reflected on your 2021 Real Estate Tax bill.

If you live in PA and open a non-PA ABLE account you may miss out on important benefits. Payment or delivery of exemption. The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. REV-1381 -- StocksBonds Inventory. 2 No part of the organizations net income can inure to the direct benefit of any individual.

Must prove financial need. They are required to report and pay tax on the income from PAs eight taxable classes of income that they receive during their taxable year. The tax rate is.

STATE AND LOCAL SALES AND USE TAX. Ad Download Or Email REV-1220 AS More Fillable Forms Register and Subscribe Now. 12 for asset transfers to siblings.

45 for any asset transfers to lineal heirs or direct descendants. Property owned jointly between husband and wife is exempt from inheritance tax. REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax.

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

2020 Estate And Gift Taxes Offit Kurman

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

State Corporate Income Tax Rates And Brackets Tax Foundation

Don T Die In Nebraska How The County Inheritance Tax Works

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation