when are property taxes due in illinois 2019

Frederick School News Great Lakes Naval Base Lake County Color Guard. Property tax due dates for 2019 taxes payable in 2020.

8 3 Who Pays Where California S Public School Funds Come From Ed100 School Fund Public School School

Welcome to Madison County Illinois.

. Week of May 23 2022. In addition the filing deadline for 2020 annual tax returns has been. 042922 Property Tax bills are mailed.

050222 Drop Box window opened. Tax Payment Period. REAL ESTATE TAX DUE DATES.

May and June 2020 Tuesday September 15 2020. Welcome to Ogle County IL. If Taxes Were Sold.

053022 MEMORIAL DAY - OFFICE CLOSED. July and August 2020 Thursday October 15 2020. Mobile Home Due Date.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. 191 KB File Size. In most counties property taxes are paid in two installments usually June 1 and September 1.

2020 - Property Tax Due Dates. When does County Board Meet. Lee County does take credit card paymente-check.

The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Illinois income taxes on April 15 2020 are automatically extended until July 15 2020. Mail Tax Bills. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due.

July 2019 - February 2020 Wednesday July 15 2020. Unsure Of The Value Of Your Property. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

County boards may adopt an accelerated billing method by resolution or ordinance. It is too early to determine the due dates for the 2021 real estate tax bills payable in 2022 but hopefully sometime in October and November will be the due dates. Contact a County Board Member.

Prepare and file 2019 prior year taxes for Illinois state 1799 and federal Free. Ad Discover the Registered Owner Estimated Land Value Mortgage Information. Property TaxesMonday - Friday 830 - 430.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Lake County IL 18 N County Street Waukegan IL 60085 Phone. Last Day to Avoid Publication.

Paying First Installment Property Taxes Early. There are many offices that hold different pieces of information about your property tax and this page is intended to get you to the answer with as few clicks as possible. Property Tax Second Installment Due Date.

173 of home value. The median property tax in Illinois is 350700 per year for a. 051122 Subtax may be paid by prior year tax buyers if going to deed.

2nd installment due date. 15 interest on 2nd installment 6 interest on the 1st installment. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

Find All The Assessment Information You Need Here. Tax Year 2020 Second Installment Due Date. The Tax Sale date for 2021 taxes payable in 2022 has not been scheduled but it.

February 14 through Tuesday March 2 2022 2019 Annual Sale. September 2020 Monday November 16 2020. Welcome to Madison County Illinois.

Tax amount varies by county. At one of many bank and credit union branches across Will County. 100 Free Federal for Old Tax Returns.

Tax amount varies by county. The bills are due in May at least 60 days after they are mailed. Maps Records Transparency.

If you are a taxpayer and would like more information or forms please contact your local county officials. Property Tax First Installment Due Date. Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Property Tax Mchenry Pin On Finance.

Property tax due dates for 2019 taxes payable in 2020. March and April 2020 Monday August 17 2020. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Physical Address 18 N County Street Waukegan IL 60085. It is managed by the local governments including cities counties and taxing districts. There are several convenient ways to pay your real estate property taxes.

060222 Per Illinois State Statute 1½ interest per month due on late payments. 062022 JUNETEENTH - OFFICE CLOSED. Ad Prepare your 2019 state tax 1799.

To pay taxes online please visit the Lee County Property Tax Inquiry website to access your tax bill. In person weekdays from 830 AM 430 PM at the. Last day to pay at local banks.

Tax Year 2021 First Installment Due Date. Cook County and some other counties use this. 2021 TAX YEAR TO BE COLLECTED IN 2022.

Real Estate Tax Due Dates. COOK COUNTY TREASURERS OFFICE Cook County Treasurers Office. Scheduled to be held May 12 through May 18 2022.

173 of home value. January 1 2020 - New Years Day. Important Tax Due Dates.

Mail payments to Will County Collector PO Box 5000 Joliet IL 60434-5000. The Illinois Department of Revenue does not administer property tax. 060122 1st installment due date.

Pay Property Tax Online Illinois Property Tax Appeal Board PTAB Common Questions. General Information and Resources - Find information. Learn about County Financials.

Tax Year 2020 Second. Tuesday March 1 2022. Illinois is not extending the filing or payment due dates for tax year 2019 returns for partnerships including nonresident withholding Form IL-1065 which still falls on April 15 2020.

June 4 2021 Published. Once you locate your tax bill a pay tax online link will be available. When are property taxes due in illinois 2019 Friday June 17 2022 Edit.

Illinois has one of the highest average property tax rates in the. Once you view the website you will be able to search by parcel number owner name and address. Election Night Results Contact Calendar Agendas Minutes Maps Employment.

Illinois has one of the highest average property tax rates in the.

Tax Information Village Of River Forest

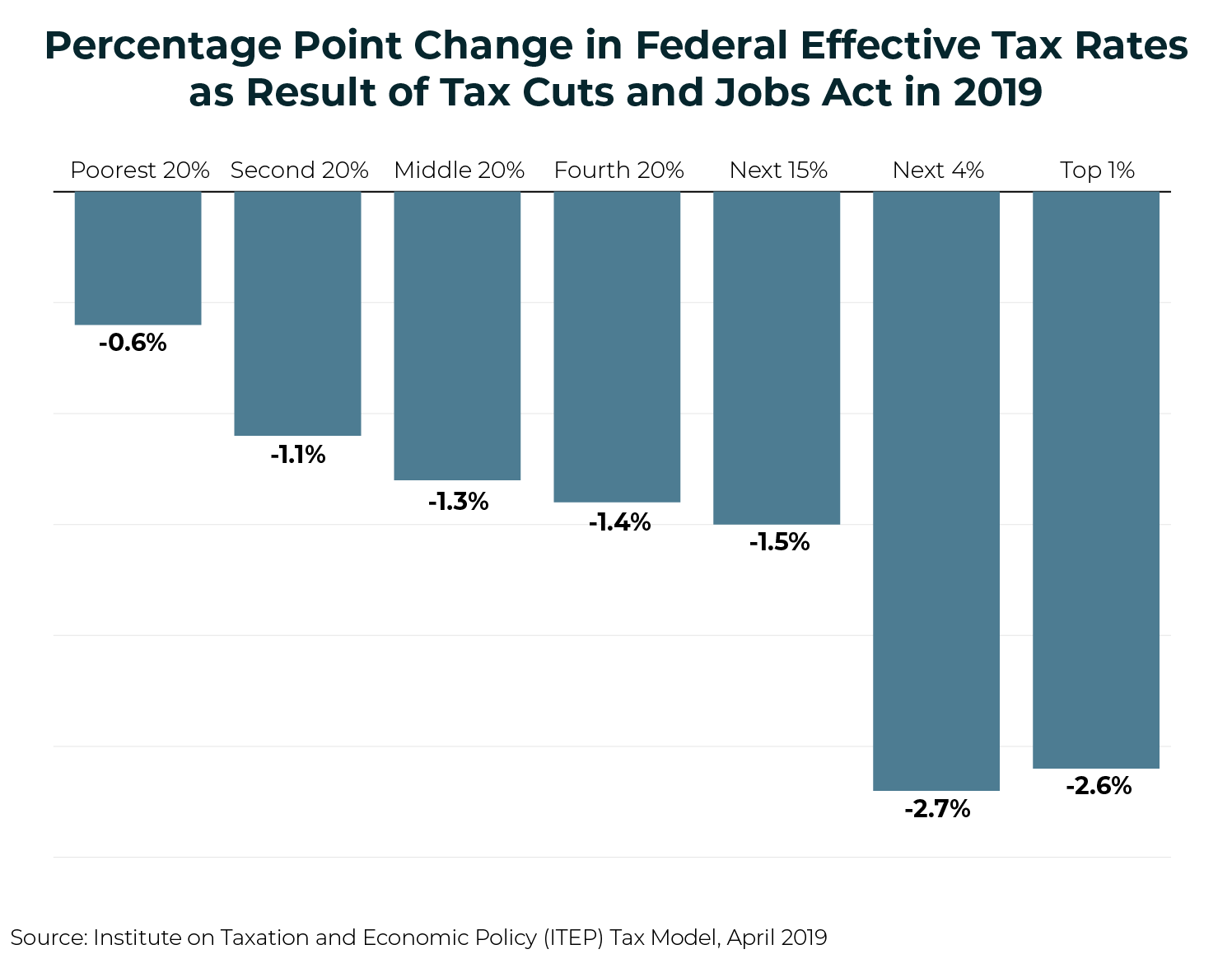

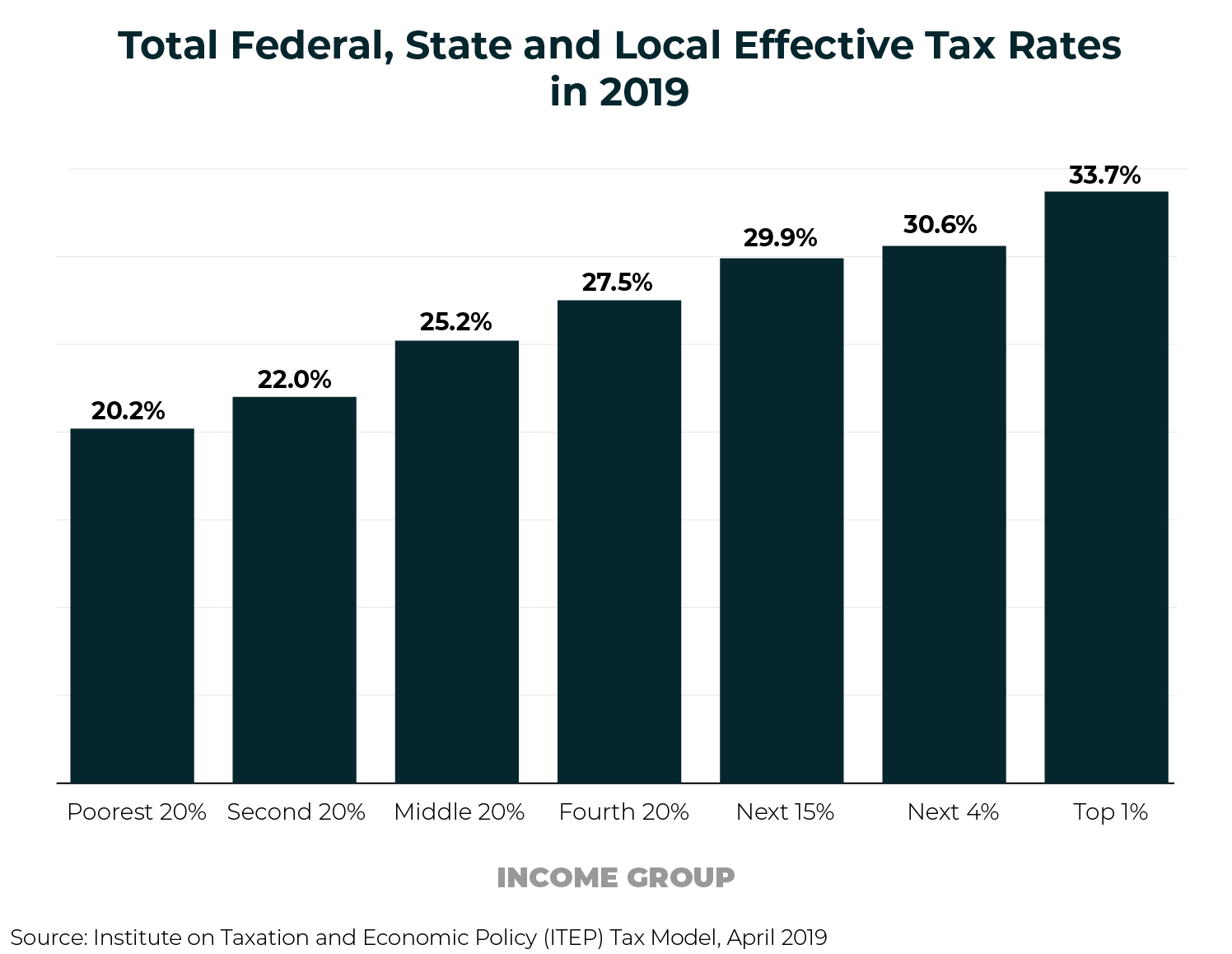

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

The Cook County Property Tax System Cook County Assessor S Office

These Are The Best And Worst States For Taxes In 2019

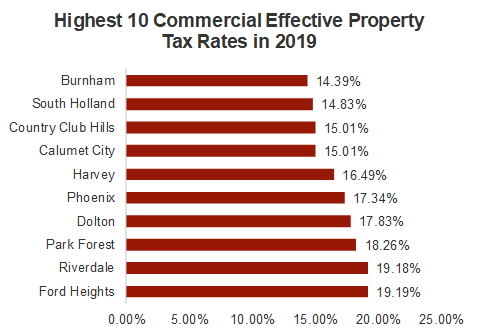

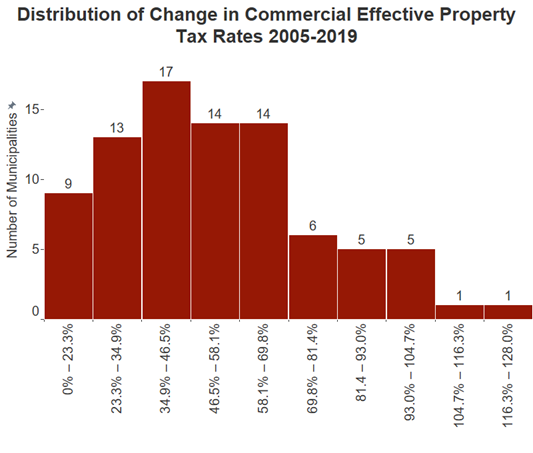

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Who Pays Taxes In America In 2019 Itep

Illinois Income Tax Rate And Brackets 2019

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

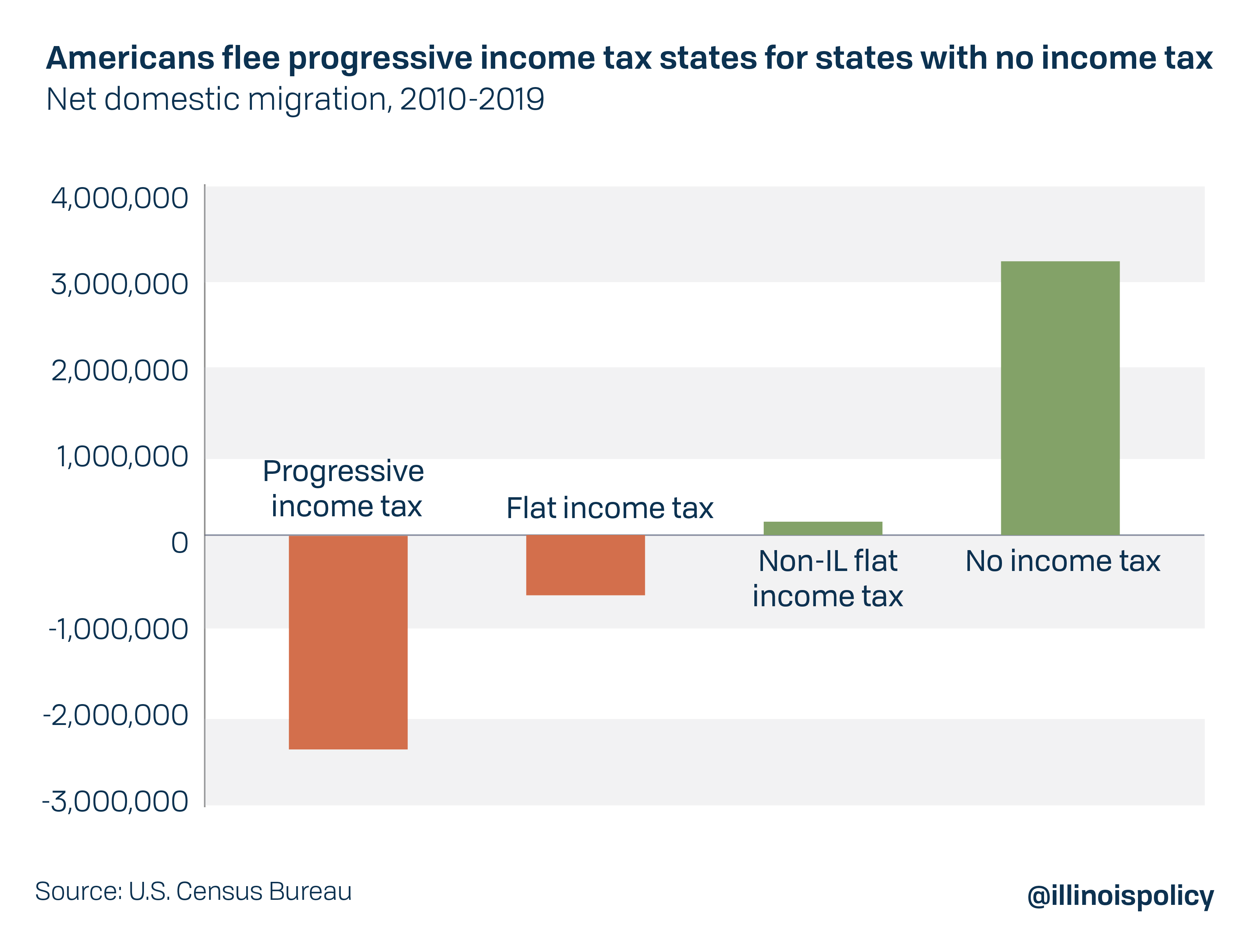

Slowest Growing States Have Progressive Income Taxes

Logan Square Saw Highest Property Tax Hike Of Any Neighborhood In The City Ald Ramirez Rosa Says

Untitled Exit Strategy Suburban Veterans Day

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Who Pays Taxes In America In 2019 Itep

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Property Tax City Of Decatur Il

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center